Daily Telegraph - ‘Inflation has wiped 30pc from my portfolio – but the worst may be over’

Fund manager Simon Barnard explains why his £2.5bn investment trust will bounce back

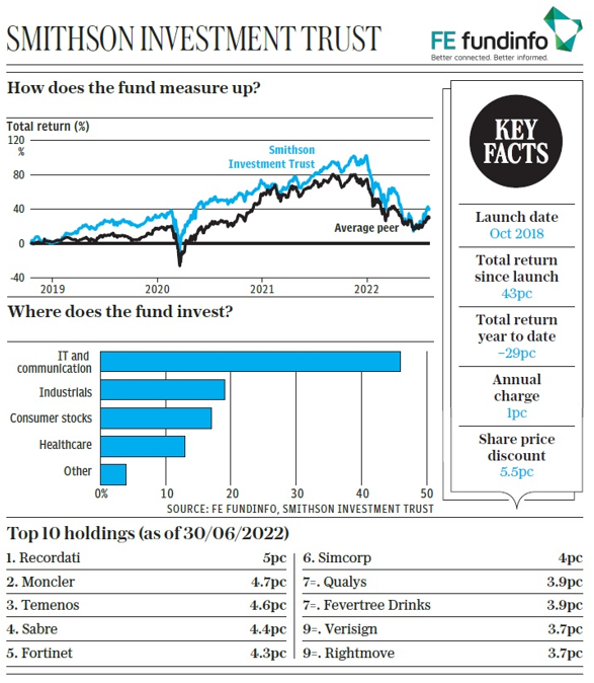

After it raised record-breaking sums from investors when it floated in 2018, the Smithson Investment Trust has had a torrid 2022 so far.

The £2.5bn fund, which invests in global small and medium-sized companies, has struggled over the past 12 months, with its assets falling in value by 19pc. This compares with a 20pc drop from rivals and a 7pc loss by its sister fund Fundsmith Equity, which is managed by renowned investor Terry Smith and focuses on much larger companies.

The trust’s manager, Simon Barnard, tells Telegraph Money why he remains confident in his strategy following this tough period and why inflation may already have peaked.

How do you invest?

The strategy is identical to that of Fundsmith Equity in so far as we invest in a small portfolio of high-quality companies and we try not to overpay for them. We then do as little as possible, which means our turnover and costs are minimised. It also means the companies we own are given a chance to compound in value over time. In practice this means we aim to hold them for five to 10 years, but ideally we would hold them forever if nothing caused us to sell.

In our opinion a high-quality company has to have high returns on capital, which means a good return on the money the business has invested. To get that you need high profit margins and strong cash flow. The difference between us and Fundsmith Equity is that we apply this to global small and medium-sized companies, whereas they tend to focus more on large caps.

Do you avoid any companies?

We tend to avoid quite a few sectors. This is determined by the areas that we see generate long-term shareholder value. Sectors we tend to like are technology, healthcare and those that are consumer-facing, which means we avoid pretty much everything else. This includes energy, commodities, heavy industrial companies, cyclical industries like airlines and cars, regulated industries such as utilities and asset-heavy industries like real estate.

Why has the fund performed badly in 2022?

Performance has been tough so far this year. As inflation has increased, the market has expected interest rates to rise to control it. Central banks are doing that, but it is the expectation of higher interest rates that has tended to reduce the valuations of our companies.

They are high quality and quite fast growing, which means they have a lot more profit to come in the future than other parts of the market, so tend to have higher valuations. As interest rate expectations increase, the value of those future profits in today’s money is ultimately reduced, which means the valuation falls.

Overall, we remain confident in the long-term outlook of the companies we own, share prices aside. The strategy of investing in high-quality, growing companies has performed well through earlier cycles.

What will happen to interest rates and inflation?

Our strategy is to invest in good companies, regardless of future macroeconomics. As we can’t predict that, we don’t spend too much time thinking about it. What I would say is that, given the increase in interest rate expectations that are weighing on the share prices of our companies, it makes sense that this pressure will be relieved once interest rate expectations from the market stabilise.

That requires us to see the peak in inflation because as soon as that happens we can get a better sense of the overall size and shape of the interest rate cycle that is needed to contain inflation. Unfortunately, the actual peak of inflation can only be determined after the fact because we need to see a few months of declining inflation, but there is a possibility we could well be living through peak inflation now.

Are your holdings protected against recession?

The vast majority of our companies are not particularly cyclical. They have high margins and a lot of cash on the balance sheet with very little debt, so fundamentally they should be fine.

What has been your best investment?

Since we bought Fortinet, the cybersecurity company, in September 2020 it has gone up by 155pc. As you can imagine, issues in cybersecurity are not going away, recession or not.

And your worst?

Unfortunately, because the travel industry was devastated during the pandemic, the worst performer has been Sabre, a software company that serves the sector.

The travel industry is recovering only now. We have seen signs of life in Sabre, but it has been a long slog through the pandemic.

In focus: Moncler

This Italian fashion brand is a well run company. It has high margins and returns on capital and is increasing its market share. It has also acquired Stone Island, another Italian luxury brand, which is in a similar position to where the Moncler brand was in the early 2000s. The firm is confident that it will be able to grow Stone Island just like Moncler.

To view the article online, please click here: https://www.telegraph.co.uk/investing/funds/inflation-has-wiped-30pc-portfolio-worst/